Odgers Berndtson Life Sciences Practice explores development in the life sciences sector through PE investment and the challenges this presents for leadership.

At the height of the Covid pandemic, it seemed the life sciences sector could do no wrong in the eyes of investors. Indeed, Deloitte began its 2021 sector outlook with talk of ‘a newfound, elevated role in society’ for the industry, noting that ‘decades of scientific work and investment seemed to be overnight successes’. Of course we now know that this honeymoon period would not last for all, with many biotechs’ five-year share price charts currently resembling a theme park roller coaster – a near-vertical ascent in 2020 and 2021, followed by a white-knuckle return to earth in the years that followed . This was borne out in the executive search world, where the pace of hiring has slowed in 2023 as a result of increased investor and Board caution.

One theme which does appear to have survived the Covid era is the interest of private equity (PE) in the life sciences. With long-term population age and chronic disease only trending in one direction, the sector is seen as being comparatively recession-resistant at a time of economic volatility. PE has therefore sought to identify in-sector opportunities which provide predictable, forecastable revenue streams, whilst still providing sufficient potential for growth and attractive exit multiples.

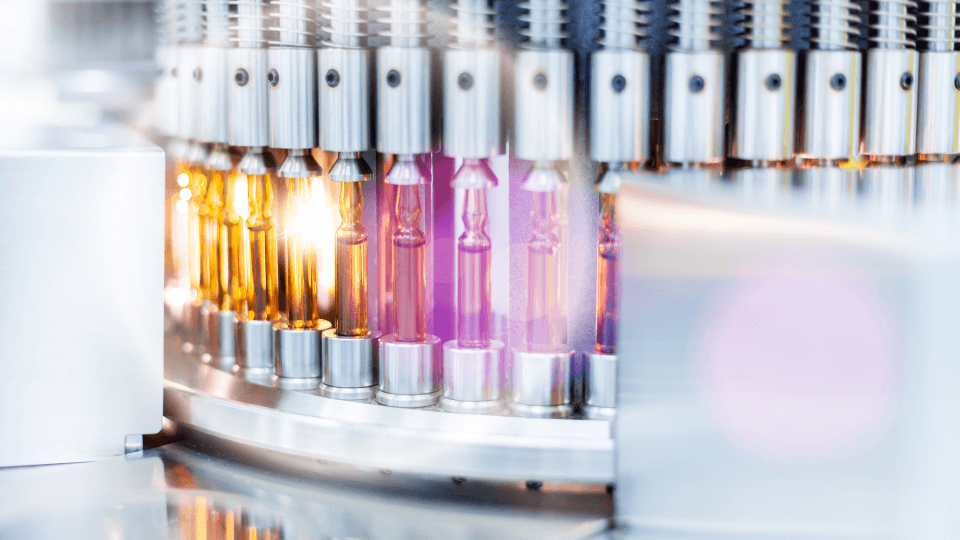

In practice, this has led to increased interest in what are collectively known as ‘pharma services’ companies; specifically contract research (CRO), contract manufacturing (CDMO), specialty packaging, distribution and consulting businesses. These groups continue to benefit from a trend within pharmaceutical companies to ‘rent’ rather than own research and manufacturing capacity, in order to de-risk the impact of development programmes on their bottom line. PE sponsors accounted for more than half of pharma services deals in 2022 and, although tempered by global economic instability, recent market activity indicates continued enthusiasm for the sector. At the upper end of the scale this has led to some wave-making transactions, such as the 2021 acquisition of Parexel by EQT and Goldman Sachs Asset Management, for $8.5bn.

With long-term population age and chronic disease only trending in one direction, pharma is seen as being comparatively recession-resistant at a time of economic volatility.

However, for every major multinational in the mould of a Parexel, IQVIA or Catalent, there are dozens of smaller regional players with strong networks, client relationships and reputations in their local markets. Accordingly, the bulk of the M&A activity takes place in the mid-market, where investors see a fragmented landscape and therefore the opportunity to pursue a ‘buy and build’ approach of achieving growth through the execution and integration of multiple smaller, strategic acquisitions.

Having completed an acquisition or two, attention inevitably turns to integration, and this is where investors can come unstuck. According to a 2023 survey by BDO, ERP integration is the top post-M&A operational challenge for PE firms and their portfolio companies.

Alongside systems and the processes that underpin them, the executive and senior leadership teams will generally also come under the microscope. The most obvious and perhaps most common change is in the very top jobs, with Chair and/or CEO taking their earn out and moving on to the next challenge. When considering the replacement chief executive, the more hands-on investors will often exhibit a preference for first-time CEOs, who are perhaps a little more malleable and open to being guided by experienced investment directors. Candidates looking to move up from CFO or COO positions tend to do well in this scenario. PE firms looking for CEO candidates with listed company/IPO experience isn’t uncommon and gives candidates a clue as to their likely exit strategy for the business. Board composition will also evolve, with one or two of the investment team taking a seat at the table whilst possibly also looking to add experienced non-executive perspectives via external recruitment.

Elsewhere in the senior leadership team, investors will frequently look to ‘over recruit’ to certain key positions, to prepare the business for where they intend to take it. In this scenario, the group operations director may be superseded by a COO; the HR director by a chief people officer; the head of legal by a general counsel and so on. Investors and Boards need to strike a balance between retaining the company's existing culture and adding new skills to the leadership team.

The arrival of a chief business officer, group strategy director or M&A director might indicate international expansion plans and individuals with experience in those target markets will find themselves in demand.

Those who have experienced a PE investment cycle and taken a business through a successful exit are in pole position when it comes to these searches. As headhunters, it therefore becomes incumbent on us to not only understand the business as it stands today, but also the plan for growth, in order to present a compelling vision of the future direction of the company to top-tier talent. Executives new to the PE world can be dazzled by the potential for large payouts from equity packages. However, it is important to remember that these payouts are not guaranteed and that PE firms are quick to make changes if they feel the management team is not performing.

In its 2023 sector outlook, KPMG predicted that in the event of a recession, ‘biopharma services companies are likely to outperform the overall market, as they have in past economic downturns’. This goes some way to explaining the ongoing enthusiasm for pharma services businesses amid market turbulence elsewhere. The report does however also note that ‘a disconnect between buyers and sellers over valuations has slowed deal making in the subsector’. As we move towards 2024, resolving this disconnect is key to unlocking the next flurry of deal activity and with it, the next wave of compelling executive and non-executive opportunities.

Follow the links below to discover more about our expertise or to contact your local Odgers Berndtson office.

Never miss an issue

Subscribe to our global magazine to hear our latest insights, opinions and featured articles.

Follow us

Join us on our social media channels and see how we're addressing today's biggest issues.