Since we first published this piece the end of February, Russia invaded Ukraine. Now Western Europe has made a dramatic change in their thinking about national security and defence. Hence, we have added a 7th Talent Trend, included as the first bulleted Talent Trend and Recommendation below.

With the continuing spread of Covid 19 and its new variants throughout the world in 2021, the Aerospace & Defence and National Security sector made significant changes in response to a new environment for recruiting, developing, and retaining talent. Technological advances in a very competitive and tight talent market due to the Great Resignation also contributed to shifts in the search for top talent.

Many industries are facing transitory environments with new technologies having an impact on their markets and organisations facing significant challenges in finding the right executives to lead their companies into the future. According to McKinsey senior partner Scott Keller, some corporate leaders are narrowing their focus on the limited number of roles that create the most value for the company to ensure the organisation at least retains and attracts the most qualified people. We will continue to see both transitory and lasting changes in the talent market in Aerospace & Defence in 2022. Looking ahead in 2022, we see the following six talent trends and provide recommendations for how senior leaders can respond.

1. War in Ukraine reshapes Europe’s security and armament plans

Western Europe has done a 180 degree shift in their views towards national security and defence – led by Germany’s $100B spending increase: See The Wall Street Journal. This strategic shift will have deep repercussions in indigenous defence businesses in Western Europe for years given the previous lack of investment. As a result, there are going to be significant expenditures in a number of defence market segments. Additionally, U.S. and European firms will be spending more time working together and collaborating on ways to best position the sector for this profound strategic shift.

Recommendation: Aerospace & Defence Companies will need to have local knowledge of the on-the-ground situations in Europe and will need leaders who can be strategic and lead through times of great ambiguity -- and even more change. They may also want to look to leaders with military backgrounds and experience to help lead them in this time of major disruption.

2. Fundamental shift in how work is performed including working remotely, geo-locations

Of course the pandemic has accelerated this trend. While many Aerospace Defence & National Security companies have manufacturing that requires in-person work and working out of secured locations, candidates and employees are increasingly pushing back on the need for employees in all roles and all situations to be in the office in a traditional 9-to-5 format. We have seen candidates decline jobs, we have seen top candidates eliminated from consideration due to relocation requirements, and we have seen companies lose top talent due to a lack of flexibility around this fundamental shift in the workplace. According to a Salesforce.com 2021 report, “Today, organisations of all sizes are looking to build hybrid workplaces to accommodate this new way of working.”

Recommendation: Larger companies will need to pivot to a mindset of “working smarter not harder,” and having people work where they need to (in person if required but not in person if not required) or they risk a continued loss of top talent.

3. Diversity & Inclusion

As we saw in 2021, there continues to be an emphasis on recruiting diverse talent into Aerospace & Defence and National Security firms. However, there remain considerable challenges around retention and having organisations evolve to become truly diverse and inclusive. In successfully recruiting diverse executives to Aerospace & Defence clients, we have found that companies that have built cultures focused on inclusion by fostering gender partnerships, diversity training programs, as well as holding leaders accountable for diversity, have strong track records of retention. For example, Northrop Grumman cultivates an inclusive talent pipeline through partnerships with the Society of Women Engineers (SWE), the National Society of Black Engineers (NSBE), the Society of Hispanic Professional Engineers (SHPE), Society of Asian Scientists & Engineers (SASE), Great Minds in STEM, Out & Equal Workplace Advocates, DisabilityIN, and Black Engineer of the Year Awards (BEYA). L3 Harris partners with similar organisations and regularly attends the Grace Hopper Celebration, the Society of Women Engineers (SWE) conference, the National Society of Black Engineer conferences, the Patti Grace Smith Fellowship which was launched in response to the death of George Floyd, and Skillbridge, a U.S. Department of Defence program that offers transitioning military members opportunities to develop valuable civilian work experience.

Recommendation: According to a 2020 MIT study, companies with greater gender diversity are associated with higher R&D intensity, obtain more patents and report higher levels of overall innovation, particularly when there is a critical mass of diverse board directors. The MIT research also found that investment in recruiting diverse candidates to company boards of directors creates positive feedback loops that pave the way for recruiting more diverse talent in general. Continued focus on diversity in searches and also move beyond to measure success in onboarding and retention. From our experience, presenting a diverse candidate slate at the start of any search is critical to success.

4. Supply Chain

As 2021 unfolded and industries across sectors were impacted by supply chain interruptions, Aerospace & Defence and National Security companies were impacted as well, particularly in the electronics marketplace. This resulted in a need to recruit top supply chain talent. A challenge faced by Aerospace & Defence firms has been that the competition for this talent is high and compensation for top talent has risen. Companies have not always been able to move quickly enough and accept the higher compensation levels to attract top supply chain talent. As one top executive said in a February 3, 2022 Wall Street Journal article, “Supply chain could be one of the biggest advantages a company has or doesn’t have.” So, Aerospace & Defence companies that recognise the need for the best talent in this area, understand the compensation trends, and are fast movers, will have a competitive advantage in the marketplace.

Recommendation: Competition for top supply chain appears to be here to stay. Companies need to adjust accordingly and be willing to pay and show flexibility on geography and compensation.

5. Innovative models to address talent shortfalls

Companies have talked for years about the “talent cliff” where there would be a situation of 30+ year employees with deep technical experience retiring and not having the talent to replace them. Well, that is happening now. Companies need to pivot and figure out how to flexibly engage this talent – e.g., project based, interim management, specialty services, etc. For example, Odgers Connect recruits more interim talent than any other search firm due to the trust that we have developed with clients, our preeminent referencing, and our ability to help clients with onboarding. Additionally, large, established Aerospace & Defence companies may want to partner with scrappier startups to learn from them and help them develop new talent models. Those that move quickly to recruit people who may not have the long experience but have different management styles and organisational frameworks will develop new team cultures and will be better positioned in terms of innovation and the extremely competitive marketplace for technical talent. As Nicole Storozhenko, an engineer with Anduril, a Lux Capital-backed, A&D company, says, “You have to be a very good self-learner and be open to new concepts and operating in ways that maybe you aren’t used to operating. But that’s what makes it fun.”

Recommendation: Understanding the tight job market and the need for different talent models, interim and project-based engagements, and more efficient management approaches will be an effective way to ensure experience is retained at the enterprise level.

6. Sustainability trends

With the introduction of Advanced Air Mobility (AAM) as companies develop electric vertical take-off and landing (eVTOL) aircraft along with increased public pressure on the A&D industry to decarbonise, companies will need top executives who are committed to sustainability and understand the need to implement environmentally sound operations, with a significant shift toward lowering carbon emissions. According to Deloitte, the market for AAM is estimated to reach $115 billion annually by 2035 so having the right talent in place to drive innovation will be critical. Adopting and advancing sustainable manufacturing technologies and practices to increase fuel efficiencies will continue to gain traction in 2022. According to James Taiclet, the Chairman, President and CEO of Lockheed Martin, “The events of the past year were a stark reminder of the importance of building a sustainable corporation.”

Recommendation: Companies should look for people from different industries, particularly in the technology and automotive sectors, with backgrounds in innovation and sustainability. They should also put a new emphasis on executives with knowledge and experience in driving sustainability efforts in their companies including having sustainability as a key leadership role.

7. High growth Space, Autonomous Systems, Artificial Intelligence and Cyber sectors

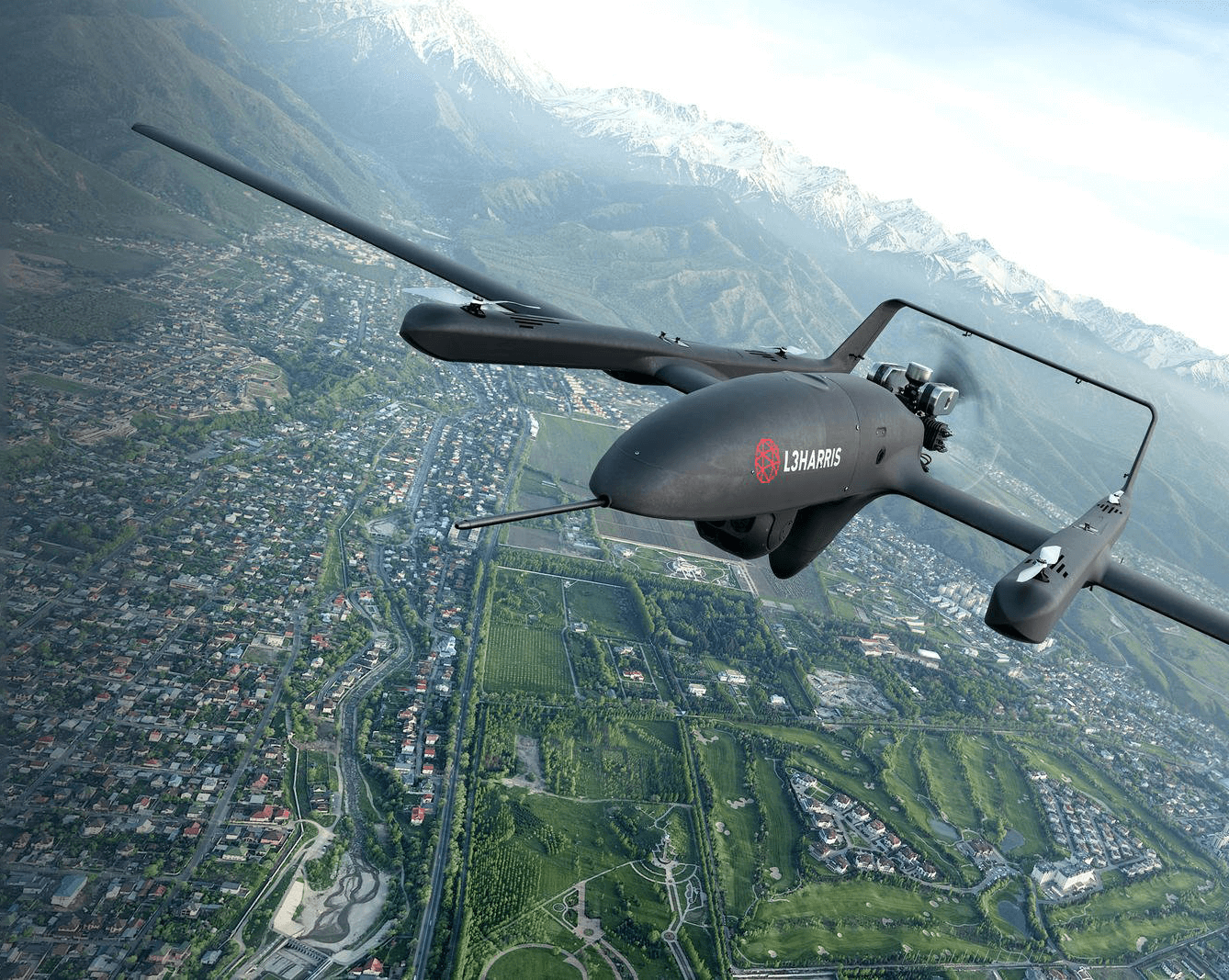

Are continuing to have a huge impact in market, representing a shift in activity across the entire Aerospace Defence & National Security marketplace globally in 2021. The combination of changing budget priorities, commercial rebound, as well as private equity and venture capital firms making continued large investments in these areas shows no sign of dropping off in 2022. The growth in these markets is global and increasingly smaller firms with PE and/or VC backing are competing with larger firms for top talent.

Recommendation: Recognise that the traditional marketplace is shifting and that competition for talent is no longer just coming from traditional larger firms. High-growth smaller companies are moving quickly and are offering compelling opportunities to candidates. For larger companies, speed in recruiting, developing and retaining talent is paramount.